My latest for Learn Liberty looks at proposals for starting an equalization program to redistribute from rich to poor states in the U.S. and finds them wanting. Due to the audience for that blog, I kept that post nontechnical and brief. I'll reproduce part of it here and then elaborate on some of the complexities … Continue reading Federalism Isn’t Unfair

Category: Political Science

Should the U.S. Recognize Catalonia If It Secedes from Spain?

Over at Learn Liberty, I take up the question of what the rest of the world should do if Catalonia's referendum on independence on October 1 succeeds, as is expected. I apply some straightforward assumptions about justice and individual freedom to the case. Secession is hard because it always involves violating some people's rights -- … Continue reading Should the U.S. Recognize Catalonia If It Secedes from Spain?

The Health Care Shell Game: Why Not Leave Policy to the States?

In my latest blog post for Learn Liberty, I take on arguments against decentralizing health care policy to the states on the grounds of fiscal capacity: So if federal ACA spending were cut or even zeroed out, why couldn’t states that like the legislation simply reinstate the same taxes and spending that the federal government … Continue reading The Health Care Shell Game: Why Not Leave Policy to the States?

Where Were the Libertarians in 2016?

In 2010 and 2015, I did some data analysis to see which states had the most libertarians, based on Libertarian Party and Ron Paul election results. I've now done something similar for 2016. Unfortunately, in 2016 we didn't have a libertarianish Republican presidential candidate continue through every primary, and so we can't use primary election … Continue reading Where Were the Libertarians in 2016?

Evaluating Pinker’s Claim That States Reduced War

Did the emergence of the state reduce the rate of human death from warfare? Steven Pinker's outstanding book, The Better Angels of Our Nature: Why Violence Has Declined, surveys many reasons why you are less likely to die from violence today than your ancestors were. Part of his explanation is that warfare was constant in … Continue reading Evaluating Pinker’s Claim That States Reduced War

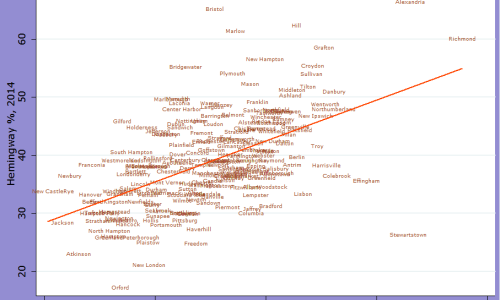

The Changing Political Geography of New Hampshire

Now that the 2016 election results are available by town for New Hampshire, I thought I would take a look at where libertarian candidates tended to do well or poorly, and how that pattern compared with conservative versus progressive support by town. To measure libertarian voting by town, I used different variables in different years. … Continue reading The Changing Political Geography of New Hampshire

Yes, Aaron Day Probably Cost Kelly Ayotte Re-Election

There's been some debate about whether independent conservatarian candidate Aaron Day (former chairman of the Free State Project Board of Directors) cost Republican Kelly Ayotte her U.S. Senate seat at this past election. Skeptics point to the fact that Day and Libertarian Brian Chabot between them about equaled Gary Johnson's vote percentage in the presidential … Continue reading Yes, Aaron Day Probably Cost Kelly Ayotte Re-Election

Partisan Politics Makes Smart People Stupid

I've started a new blogging gig at Learn Liberty, a project of the Institute for Humane Studies. I'll be putting links to these posts here. My posts there will have the benefit of an editor, which is probably something I need. The first is on partisan rationalization and why epistocracy may not save us after … Continue reading Partisan Politics Makes Smart People Stupid

My Testimony on National Self-Determination Movements to the House Foreign Affairs Subcommittee on Europe, Eurasia, and Emerging Threats

On March 15, I had the opportunity to testify at the U.S. House Foreign Affairs Subcommittee on Europe, Eurasia, and Emerging Threats, chaired by California Rep. Dana Rohrabacher, on the topic of whether the U.S. government should change its policy toward national self-determination movements. I'm posting here my written testimony (my oral testimony had to … Continue reading My Testimony on National Self-Determination Movements to the House Foreign Affairs Subcommittee on Europe, Eurasia, and Emerging Threats

How Decentralized Is Your State?

In the U.S., states have full authority over local government. Some states strictly centralize power and leave local government little to do. For instance, Hawaii has a single school district for the entire state, so that different localities cannot choose to spend different amounts on the government schools. Michigan effectively has a similar system, because … Continue reading How Decentralized Is Your State?

The Most and Least Libertarian Towns in New Hampshire (updated)

Updated to include two scatter plots Having examined which states have the most and least libertarians, I've decided to do something similar for the 239 populated towns of New Hampshire. Towns are the most important level of local government here, and therefore the degree of libertarian-ness should make some difference to policy at the town … Continue reading The Most and Least Libertarian Towns in New Hampshire (updated)

Where the Libertarians Are, Part 2

A few years ago, I did a statistical analysis of which states had the most libertarians, using data from 2004 and 2008 Libertarian Party vote shares and 2008 Ron Paul vote shares and contributions. David Boaz has prodded me to update these numbers in light of the 2012 election. This post does just that. To … Continue reading Where the Libertarians Are, Part 2

The Meaning of the Arrow Theorem

Recently I finished reading the book Gaming the Vote by William Poundstone. I also assigned part of it to my Ethics & Economics Challenge students. It's a fun and informative read, draping heavy-duty political science in engaging story-telling. (My post at e3ne.org on the topic is here.) The book's central thesis is that the American … Continue reading The Meaning of the Arrow Theorem

FDI & Civil Conflict

How does globalisation, especially foreign direct investment, influence the risk of intrastate conflict? While several prominent studies have found that globalisation reduces the probability of civil war, we use new data and methods to approach the question. In particular, we test for the possibility that foreign investment is endogenous to conflict risk and appropriately use … Continue reading FDI & Civil Conflict

Libertines, Hypocrites, and the Weak-Willed, With an Application to Socialism

Bryan Caplan argues that social conservatives should prefer libertines to hypocrites, contrary to the common meme that "at least hypocrites have moral standards." The argument is pretty simple: hypocrites seem to share your values, but when you least expect it, they will betray you. So far as it goes, the argument is pretty convincing. But … Continue reading Libertines, Hypocrites, and the Weak-Willed, With an Application to Socialism

Understanding the Impact of Holder’s Asset Forfeiture Announcement

Last week Attorney General Eric Holder announced that the Department of Justice would be suspending its adoption of state civil forfeiture cases through its "Equitable Sharing" program. To review, civil asset forfeiture is the procedure by which law enforcement seizes property suspected of having been associated with a crime, and then auctions it off and … Continue reading Understanding the Impact of Holder’s Asset Forfeiture Announcement

Just the Facts Ma’am

Dragnet's Joe Friday may have never uttered those words, but he would be impressed nonetheless by the facts on crime. There was a fascinating piece by Erik Eckholm in yesterday’s New York Times on the dramatic reductions in crime over the past several decades. Overall, crime peaked in 1991 and has fallen steadily since then. … Continue reading Just the Facts Ma’am

Update and Further Analysis of the New Hampshire Legislature

With this post, I'm reporting updated results on the ideological ideal points of New Hampshire legislators, introduced previously here. In that analysis, I found that libertarians in the New Hampshire House in 2014 tended to vote with the right (and vice versa) on most roll-call votes scored by the New Hampshire Liberty Alliance. That included … Continue reading Update and Further Analysis of the New Hampshire Legislature

Constitutions and Secession

Constitute.org is a useful website designed by political scientists to let researchers search for and compare constitutional texts on particular topics. Here for instance is a search on secession clauses. Although one of the site's creators, Zachary Elkins, says that 22 states contemplate some process for state divorce, only three constitutions expressly authorize some part … Continue reading Constitutions and Secession

This Is What a Legislature with a Bunch of Libertarians Looks Like

The New Hampshire Liberty Alliance does a Liberty Rating each year in which they analyze liberty-related roll-call votes of state representatives and senators and grade them. (The NHLA is a great government accountability organization, by the way, and well worth supporting; a lifetime membership is only $100.) I used their roll-call votes for the 2014 … Continue reading This Is What a Legislature with a Bunch of Libertarians Looks Like

*The Once and Future King* by F.H. Buckley

Frank Buckley was kind enough to send me a copy of his new book, The Once and Future King: The Rise of Crown Government in America, and now seems like an appropriate time to post my review. Buckley argues persuasively -- and surprisingly -- that the Founders intended to establish a semi-parliamentary form of government … Continue reading *The Once and Future King* by F.H. Buckley

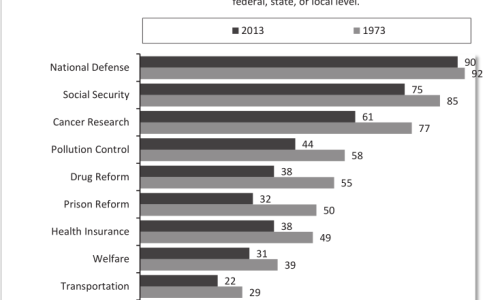

Changing American Views on Federalism

The Cato Institute has conducted a new poll of Americans' attitudes toward federalism. Apparently Americans have become much more favorable to federalism and decentralization over the past 40 years. The Cato Institute commissioned YouGov for the poll. They asked respondents questions about which level of government should have primary control over each issue area, using … Continue reading Changing American Views on Federalism

Vote Labour, Get SNP?

Since the Scottish independence referendum, the Scottish National Party has seen its membership treble and its poll ratings climb. This boost to pro-independence forces after their referendum failure departs from the script established in previous referendums on autonomy or independence. After the failed 1979 referendum on devolution (due to a turnout requirement - the measure … Continue reading Vote Labour, Get SNP?

Vox Populi

This week we celebrated Constitution Day, by among other things, watching Congress authorize funding for a war that is not a war, and allowing it to be waged on the basis of a 2001 use-of-force resolution that authorized military actions against parties involved with the 9/11 attacks (conveniently, it did not have an expiration date). … Continue reading Vox Populi

Aftermath of the Scottish Referendum

A few takeaways from the 55-45% victory for No in the Scottish independence referendum: The polls overestimated support for independence, just as in the 1995 Quebec referendum. Secession from a well-established democracy is extremely difficult due to voters' risk-aversion and status quo bias. Scotland's right to decide elicited salutary promises of decentralization from the British … Continue reading Aftermath of the Scottish Referendum

A Realist’s Guide to Grand Strategy

International relations scholar William Ruger has a nice review of Barry Posen's book Restraint in The American Conservative that is well worth checking out. Posen's book is an attempt to sketch out a hard-nosed, moderately noninterventionist grand strategy for the United States. Excerpts: Restraint, Posen’s alternative to liberal hegemony, is developed in the second chapter. … Continue reading A Realist’s Guide to Grand Strategy

Don’t Lay Down Your Arms, Aceh Edition

As part of a new paper, I've been doing research on decentralization in Aceh, Indonesia. Bringing to a conclusion an approximately 20-year insurgency, the Free Aceh Movement (GAM) and Indonesian government came together in a spirit of comity following the devastating Indian Ocean Tsunami and signed a peace deal giving the region ample new autonomy. … Continue reading Don’t Lay Down Your Arms, Aceh Edition

A Return to the Culture Wars?

This has not been a good Supreme Court term for the Obama administration. Damon Root (Reason) has a quick and delightful overview of some of the key decisions. The most recent defeat—the Hobby Lobby decision—can be viewed as a loss for the administration, but it may provide some political benefits with respect to fundraising and continuing … Continue reading A Return to the Culture Wars?

This Week in Political Violence

Want to understand the rapidly deteriorating security situation in Iraq? You can do no better than read this masterful account by Kenneth M. Pollock at Brookings. One quote: These [ISIS and other Sunni militants] are Militias First and Foremost, Terrorists only a Distant Second. Here as well, Prime Minister Maliki and his apologists like to … Continue reading This Week in Political Violence

Finally! Some Bipartisan Support for the 10th Amendment

Early Friday morning, the House passed an important amendment to the appropriations bill for Commerce, Science, Justice and Related Agencies. As Billy House reports (National Journal): Using states' rights as a bipartisan rallying cry, the House voted 219 to 189 early Friday to prohibit the Justice Department from using federal funds to conduct raids or … Continue reading Finally! Some Bipartisan Support for the 10th Amendment

What My Students Think on Some International Issues

At the end of the term, I always hold team debates in my introductory international relations course. After each team has presented, I hold a "just-for-fun" vote of the class on each resolution. This term, I had them debate the following resolutions. Some of the results surprised me, particularly since I try to craft reasonably … Continue reading What My Students Think on Some International Issues

Sorry, Damon, International Laws Are Laws

My friend Damon Linker has a new piece for The Week arguing that George W. Bush, Dick Cheney, and Condoleezza Rice cannot be war criminals, because the laws they are accused of violating are merely "international law," which is no law at all: [I]t's inaccurate to describe these rules and regulations as laws. They are, … Continue reading Sorry, Damon, International Laws Are Laws

“Fiscal Federalism, Jurisdictional Competition, and the Size of Government”

This paper of mine is now available online in Constitutional Political Economy. It empirically investigates competing theories of how fiscal federalism constrains government. The main conclusion is that different federal systems conform roughly to different theoretical models, with the U.S. - a bit surprisingly - coming closest to "market-preserving federalism." Some of the early findings … Continue reading “Fiscal Federalism, Jurisdictional Competition, and the Size of Government”

The Difference Between Governments and States

"The state," wrote sociologist Max Weber, "is a relation of men dominating men." I agree. Furthermore, no human being should dominate another human being. Therefore, the state should not exist. But I'm not an anarchist. How can that be? We have to distinguish between "governments" and "states." Anarchy is the absence of formal government, and … Continue reading The Difference Between Governments and States

More Evidence on Law of Political Entropy

"Why did the autonomous city-state die?" asks political-economic historian David Stasavage in a new American Political Science Review article. He finds that new autonomous city-states enjoyed higher population growth rates than nonautonomous city-states, up to 108 years. After that point, their population growth was lower than that of nonautonomous city-states. His argument is that the … Continue reading More Evidence on Law of Political Entropy

State Making Quotations

This term I have been teaching a new seminar entitled, "State Making and State Breaking." It's basically about state formation and capacity building from medieval Europe to contemporary Africa ("state making") plus secessionism, irredentism, de facto statehood, and other challenges to sovereignty ("state breaking"). We've now reached about the halfway point, having dealt with the … Continue reading State Making Quotations

A Law of Political Entropy?

Libertarians often bemoan the expansion of the federal government over the centuries and cite Thomas Jefferson's quotation, "The natural progress of things is for liberty to yeild [sic], and government to gain ground." Of course, there have been important advances for liberty in the U.S. in the 20th and 21st centuries too, yet overall, government's … Continue reading A Law of Political Entropy?

Why So Little Decentralization? Part Two: Secession Prevention

Having finally turned the corner on a brutal, 11-day (and counting) cold, I feel up to getting back to my blogging routine. First up: a followup to last month's post, "Why So Little Decentralization?" To review, that post posed a puzzle (a problem for political scientists to ponder, you might say). The puzzle is this: … Continue reading Why So Little Decentralization? Part Two: Secession Prevention

McCutcheon

There has been much coverage of last week’s Supreme Court decision on campaign finance (McCutcheon v. Federal Election Commission), most of it negative (insert shocked surprise here) given that it will provide more opportunities for the wealthy to shape public policy. As Senator Tammy Baldwin (D-WI) observes: "It is far too often the case in … Continue reading McCutcheon

The Right to Self-Determination in International Law and Practice

I delivered this brief talk to a Model UN conference at Dartmouth on March 28. Here is the text of my remarks. ************************************************************************************************************** My topic for tonight is "The Right to Self-Determination in International Law and Practice." The right to self-determination is one of the most controversial concepts in international relations today. The government of … Continue reading The Right to Self-Determination in International Law and Practice